reit dividend tax canada

REITs pay dividends up to 37 taxed at 38 so they tend to pay more as ordinary income. Sure you get a monthly dividend through the ETF however buying all 6 banking stocks individually will give you a higher yield albeit on a.

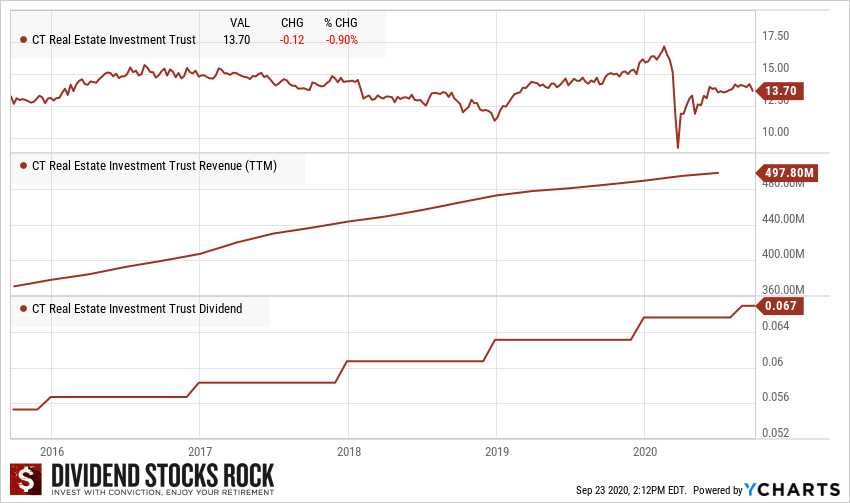

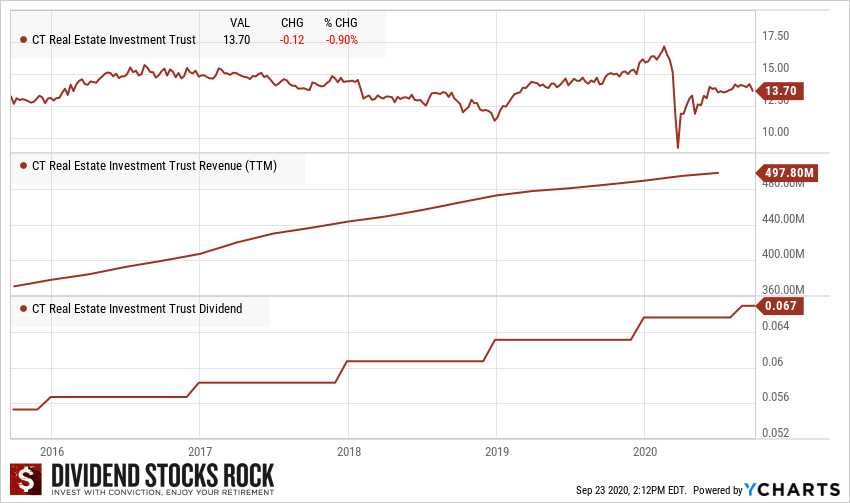

The bad thing is that these REITs werent as cheap as they once were.

. 710 if shareholder owns at least 10 of the REITs voting stock except in the case of Jamaica and no more than 25 of the REITs income consists of dividends and interest. 5 rows Canadian Dividends. The 200 other than eligible dividend had a grossed up value of 200 x 115 230 so your federal tax credit 230 X 90301 percent 2077.

Vanguard FTSE Canada Capped REIT. There is no withholding tax on distributions by the REIT to residents of Canada. 34 rows The Best 4 Canadian REITs.

Withholding tax at a rate of 15 generally reduced to 0 for RRSPs. Choice Properties is a Real Estate Investment Trust that owns manages and develops retail and commercial real estate across Canada. This 63899 million REIT owns and operates 45 commercial properties 45 in.

A 15 tax on investment income is imposed. The REIT generates 2 per unit from operations and distributes 90 or 180 to unitholders. In addition to the investment tax there is an 8 surtax.

Of this 120 of the dividend comes from earnings. And because the Albertan economy has seen some struggles for years Boardwalk stock has suffered as a result. Secondly you sacrifice dividend yield.

Dividends from REIT companies are typically taxed as ordinary income up to 37 similar to dividends from regular companies or a maximum of 39 the difference between dividends paid and regular income. REITs are required to pay out at least 90 of their taxable income to shareholders and most can even pay out 100. Again you can view the tax breakdown of CREITs distribution on its website.

Thats 25 for every 10000 invested. Or you can reinvest those dividends and leverage the capital growth. This means that dividend income will be taxed at a lower rate than the same amount of interest income.

The best tax rate on a Qualified REIT Dividend normally takes into account the 20 deduction. Canada offers special tax treatment for Canadian income trusts. Considering you could buy all 6 stocks through a brokerage like Qtrade for 30 in commission this is a significant jump.

True North Commercial TSXTNTUN trades at less than 10 744 per share but pays an ultra-high 802 dividend. The remaining 060 comes from depreciation and. The fee is reasonable enough and if you invest a substantial amount in this fund you can start a passive income just through dividends.

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. The majority of REIT dividends are taxed as ordinary income up to a maximum rate of 37 returning to 396 in 2026 plus a 38 percent surtax on investment income. Federal income tax purposes generally will be subject to US.

When they flow their income through to their unitholders the REITs dont pay much if any corporate tax. However income distributions to nonresidents will attract a 25 withholding tax and nonincome distributions will attract a 15 withholding tax. The Canada Revenue Agency applies a 150198 tax on the tax portion of eligible dividends and a 9031 rate on the tax portion of non-eligible dividends.

Because of the tax deferral ROC is considered tax-efficient income. You will report the total federal credit amount in. 23 rows While US.

Preferred Canadian Dividend Tax Rate. Distributions paid by the REIT to a Canadian unitholder that are made out of the REITs current or accumulated earnings and profits as determined for US. In 2013 and the grocery chain is its biggest tenant today.

Total federal credit 4145 2077 6222. Through December 31 2025 taxpayers can deduct 20 of their combined qualifying business income which includes Qualified REIT Dividends. The REIT collects rental income pays its expenses and then distributes almost all.

In 2026 there will be 3 plus 6. Nevertheless Dream Industrial is arguably the cheapest REIT among its industrial REIT peers. In 2026 the deficit will increase to 6 with a separate 3 increase.

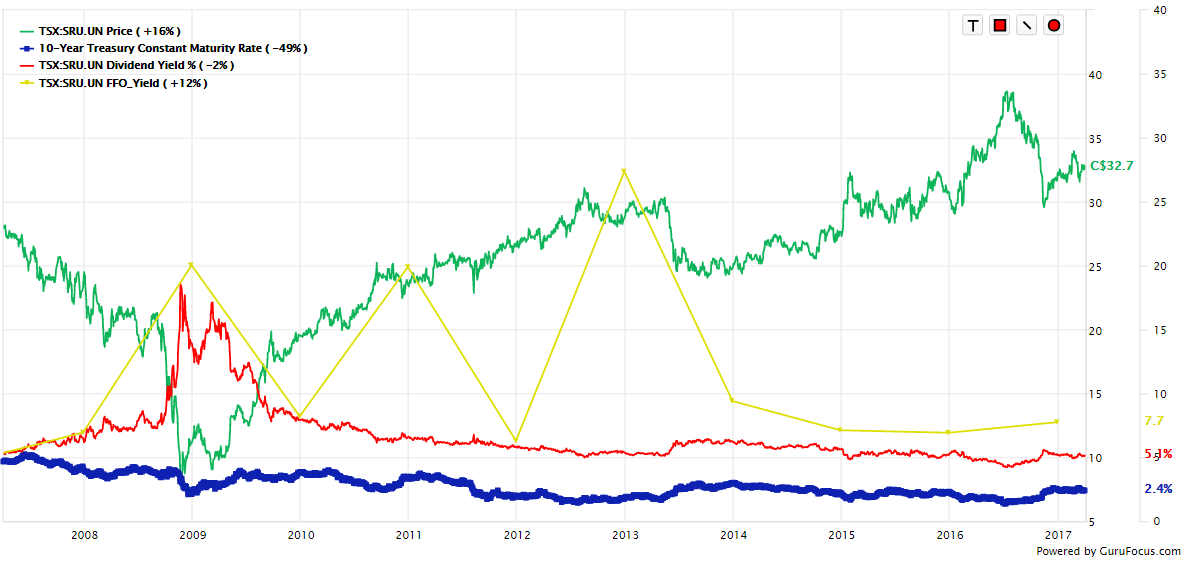

Now lets look at a second example Canadian REIT. With over 650M in liquidity at their disposal dont be surprised if Dream adds to their 18B in acquisitions theyve completed thus far in 2021. In the case of mortgage REITs mREITs note that these companies do not directly own real estate.

Choice Properties was spun out by Loblaw Cos. Although some exclusively operate inside Canada many also have international holdings. 915 tax rate if shareholder owns more than 50 of the REITs voting stock.

Taxpayers who hold Canadian dividend-paying stocks can be eligible for the dividend tax credit in Canada. In exchange the shareholders pay income taxes on those dividends. Investors pay tax on most of the distributions as ordinary income although part of some distributions qualify as a tax-free return of capital.

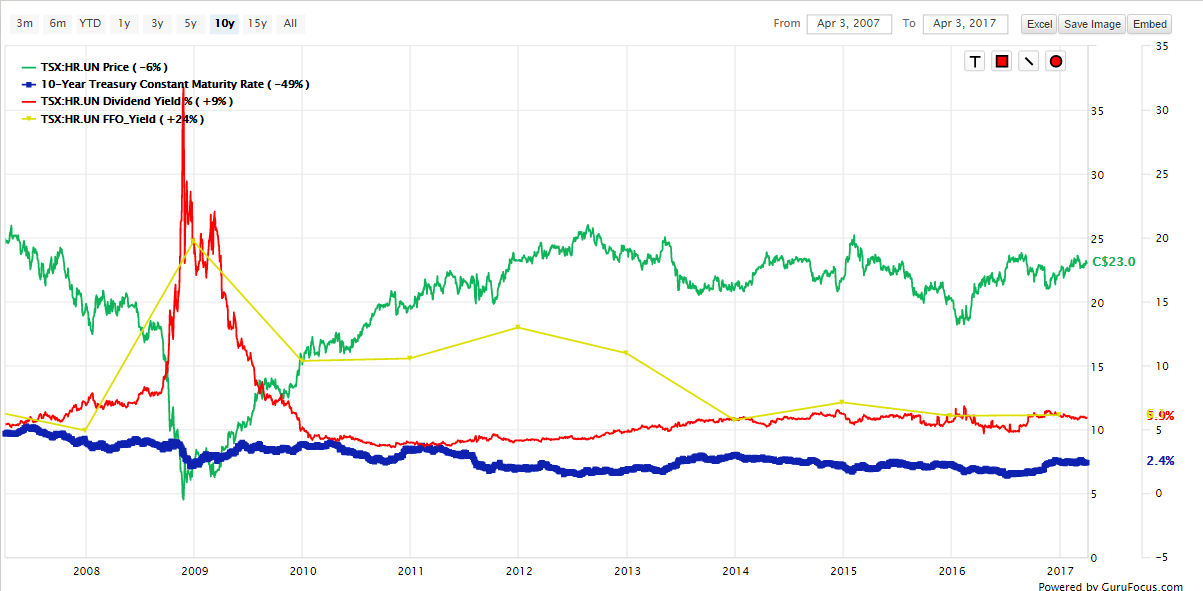

Investors in the highest tax bracket pay tax of 39 on dividends compared to about 53 on interest income. 830 tax rate if shareholder owns 25 or more of the REITs stock. Boardwalk is a residential REIT with more than 60 of its portfolio in Alberta.

REITs typically pay quarterly dividends most Canadian REITs pay. The withholding tax rates may be reduced if there is a tax treaty with the country in which the nonresident resides. Taxpayers may also generally deduct 20 of the combined qualified business income amount which includes Qualified REIT Dividends through Dec.

Dividends are taxed at a lower rate than some other income.

24 Best Canadian Reit Stocks Currentyear Reit Real Estate Investment Trust Investing Money

How To Buy Stocks In Canada A Beginners Guide To Investing In Stocks In 2021 Investing In Stocks Investing Money Management Advice

24 Best Canadian Reit Stocks 2022 Invest In Real Estate

Reits Canada Still Offers Tax Advantages For These Investments

Reit Taxation A Canadian Guide

Reit Taxation A Canadian Guide

Reits Canada Still Offers Tax Advantages For These Investments

Why Asset Location Matters Fidelity Personal Financial Planning Investing Real Estate Investment Trust

Introduction To Canadian Reits Seeking Alpha

Top 3 Canadian Reits For 2020 And Why Riocan Is Not Part Of It Seeking Alpha

5 Best Reit Etfs In Canada 2022 Easily Invest In Real Estate

Pin On Dividend Investing Ideas

Another Increase To The Canada Child Benefit Country 94 Mlm Scheme Money Starting A Business

Introduction To Canadian Reits Seeking Alpha

How To Build An Income Portfolio Using 12 Simple Steps My Own Advisor Dividend Investing Investing Income